The Virtuous or Vicious Circle of Artificial Intelligence?

November 30, 2022

I will always remember the day ChatGPT was released. I was at the office and, out of curiosity, I wondered what this technology was capable of. After asking this artificial intelligence (AI) to provide me with the programming language needed to develop a predictive algorithm and to explain each line of code, I began to glimpse the possibilities of this revolution.

How was it possible for this technology to respond with such precision? What impact would this technology have on our lives? What would be the limit of the expectations that this solution seemed to offer?

After more than three years, I now wonder whether the inflated expectations surrounding this technology are leading us toward an AI bubble.

5,000,000,000,000 dollars

A few months ago, Nvidia surpassed five trillion dollars (USD 5,000,000,000,000) in market capitalization, equivalent to the gross domestic product (GDP)—the wealth produced by a country in one year—of Germany (1).

This company, which has transitioned from producing chips for video games to manufacturing chips required for AI, could be described as the world’s third-largest “country” in terms of GDP generation, behind only the United States and China (1).

These astronomical figures confront us with the reality that investor expectations are not rational.

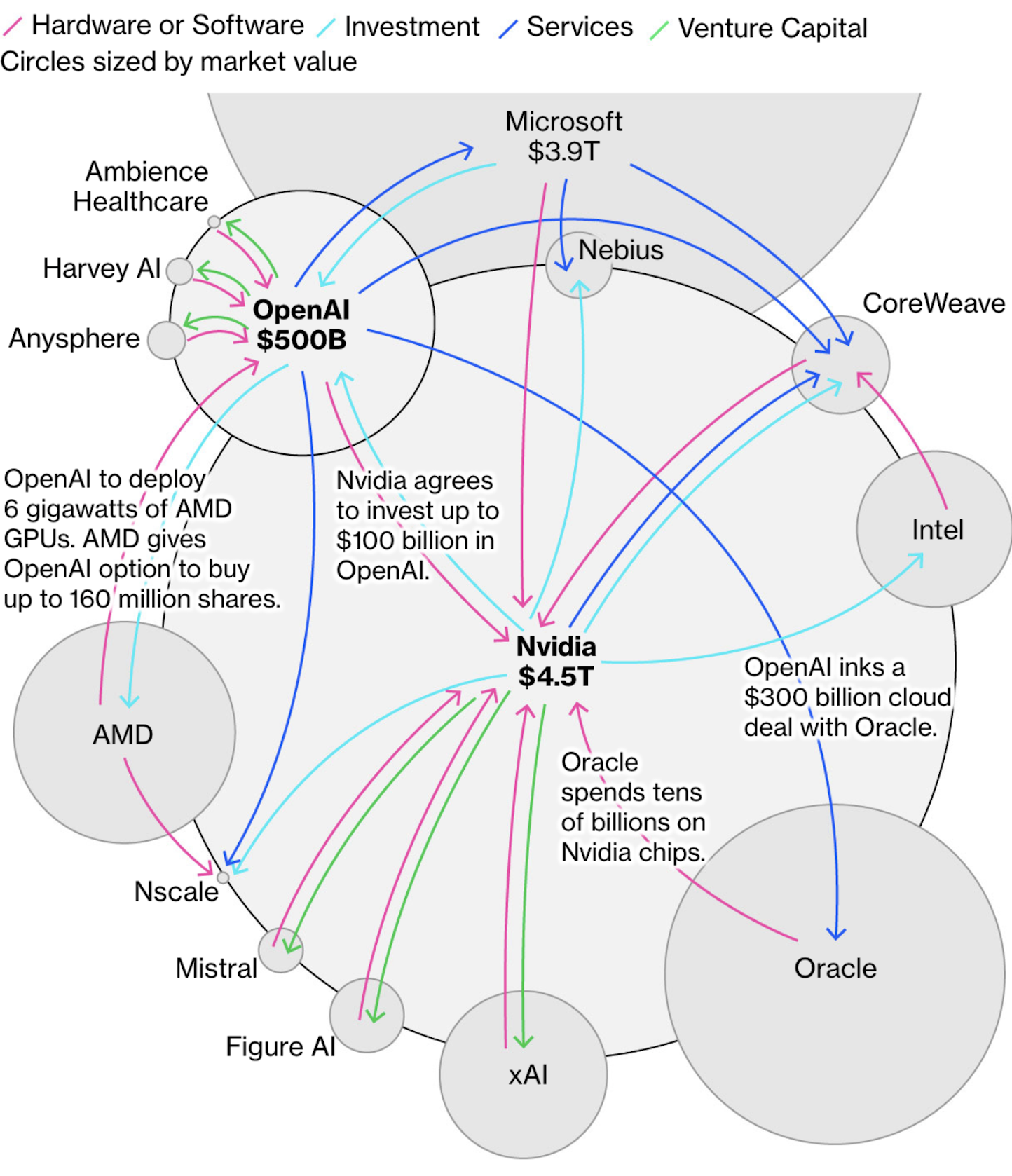

Until now, investors believed that the circular investments among three companies—Nvidia (which holds a monopoly over the production of AI chips), Oracle (which builds a large share of the data centers used to train these algorithms), and OpenAI (which developed the technology)—represented a virtuous circle of growth with unprecedented profit expectations.

Last October, Bloomberg published an article in which an image illustrated the order of magnitude involved (2). This circularity is based on the fact that, for example, Nvidia invested $100 billion (USD 100,000,000,000) in OpenAI; OpenAI signed a $300 billion contract (USD 300,000,000,000) with Oracle; and Oracle purchased billions of dollars’ worth of chips from Nvidia. The perfect virtuous circle of circular investment.

However, the question many investors are asking today is whether we are, in fact, facing a vicious circle that could cause the AI bubble to burst.

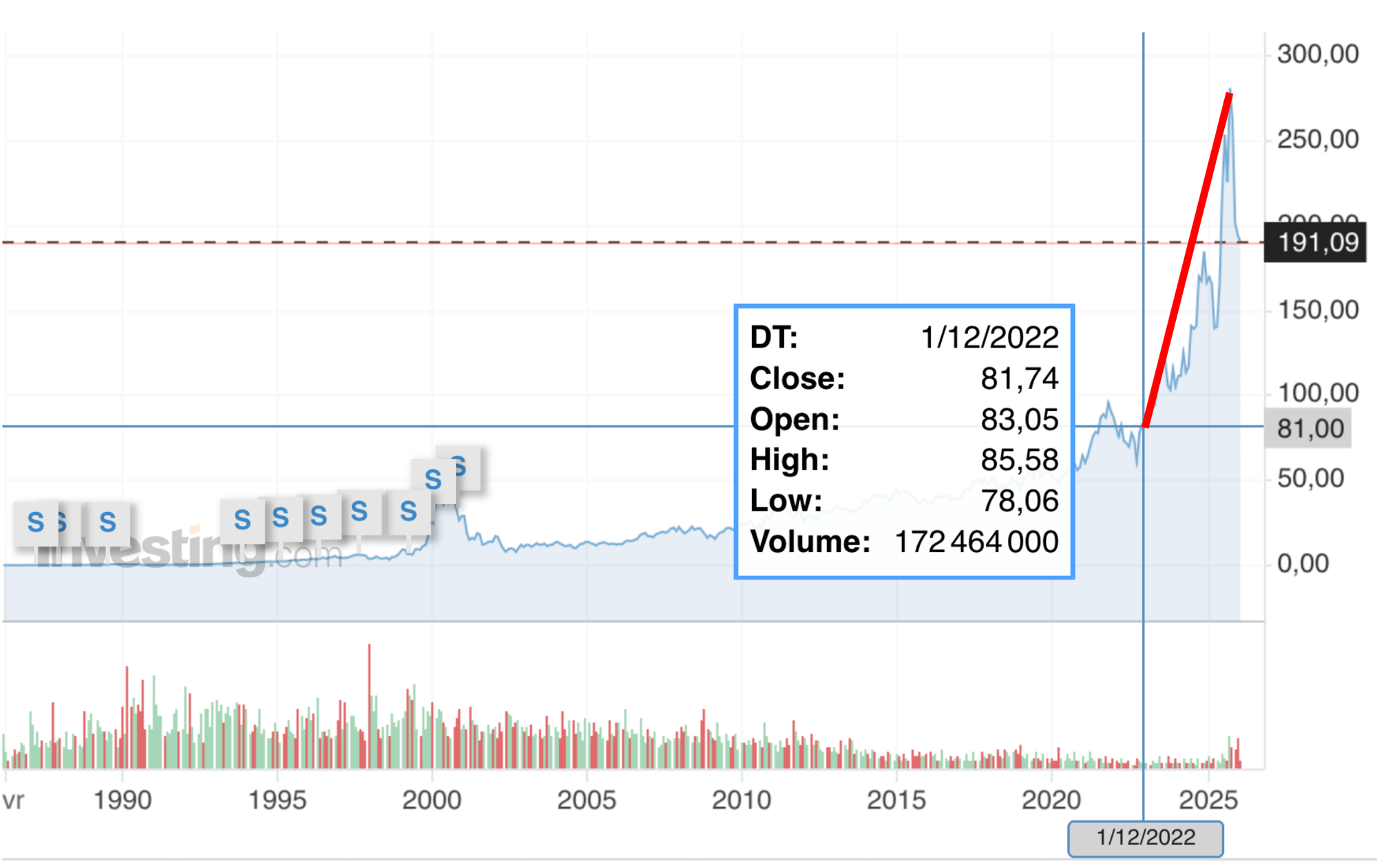

They say a picture is worth a thousand words. Since the release of ChatGPT on November 30, 2022, Nvidia (3) and Oracle (4) have experienced exponential stock market growth.

Currently, Oracle’s debt—incurred to invest billions of dollars in building data centers—is already being classified as non-recoverable (5).

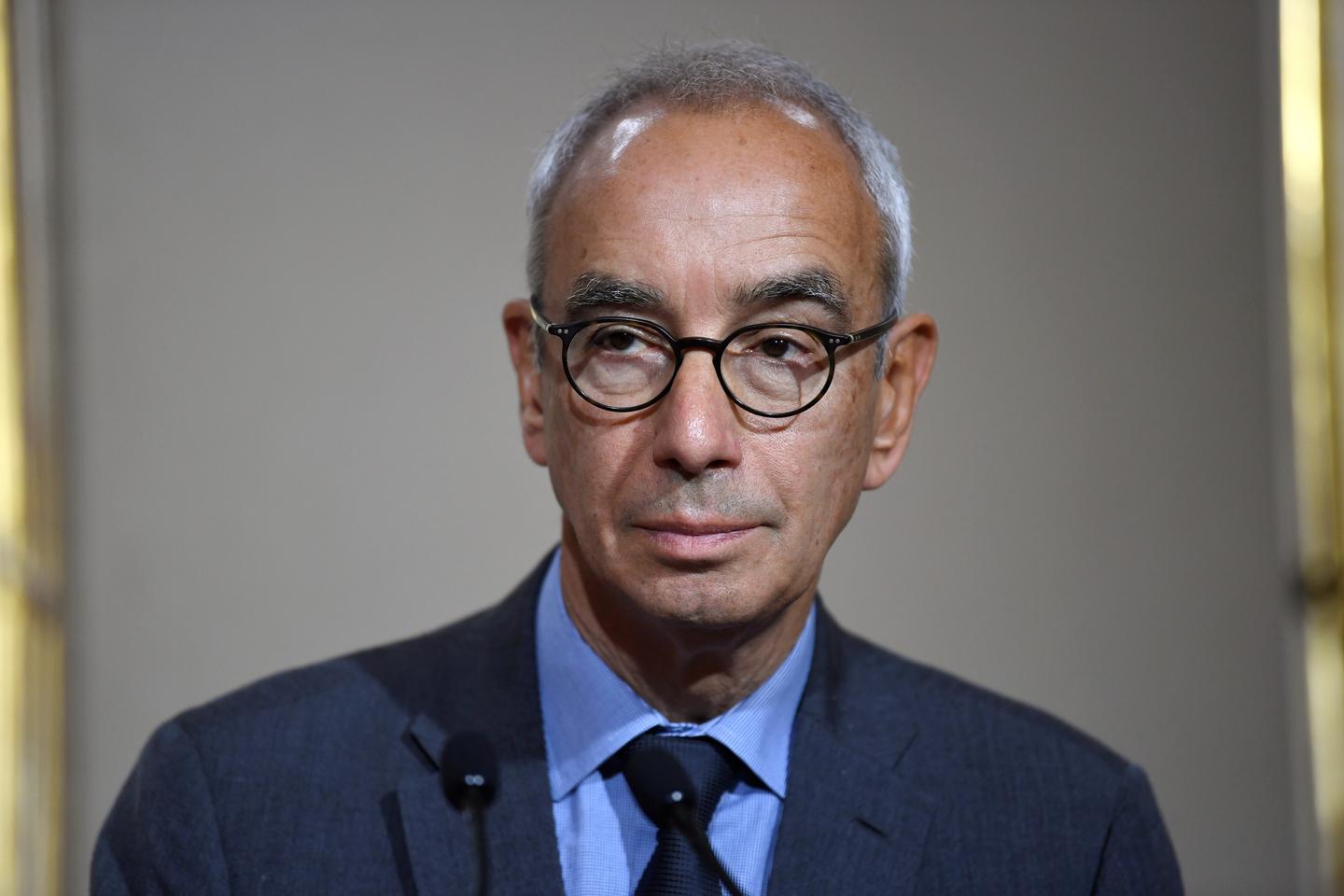

Economist Jean Pisani-Ferry argues that the difference between this potential AI bubble and the Internet bubble of the early 2000s lies in the fact that today these investments are concentrated among the so-called “Magnificent Seven” (Alphabet—Google—, Amazon, Apple, Meta—Facebook—, Microsoft, Nvidia, and Tesla) (6).

The recognition that expectations surrounding this technology must be recalibrated is gaining increasing traction.

Sundar Pichai, CEO of Google, told the BBC that there is an “irrationality” in the current AI investment environment (7).

Ilya Sutskever, co-founder of OpenAI, stated last August that “in Silicon Valley there are more companies than ideas” (7).

Sam Altman, CEO of OpenAI, also stated last summer that “someone will lose an enormous amount of money,” adding that the big question is that “we do not know who” (7).

Irrationality or reason?

In November 2022, I may have told myself that expectations for this technology were limitless.

Even today, some investors likely remain convinced that the possibilities of AI have no bounds.

It only remains to determine when this “virtuous circle” will collapse under its own weight, and when market irrationality will give way to reason.

(1) Intel·ligència artificial, aroma de bombolla

(2) OpenAI's Nvidia, AMD Deals Boost $1 Trillion AI Boom with circular deals

(5) Oracle, symbole du dégonflement de la bulle de l’IA

(6) Jean Pisani-Ferry, économiste : « L’IA nourrit-elle une nouvelle croissance ou une bulle ? »

(7) What even is the AI bubble?